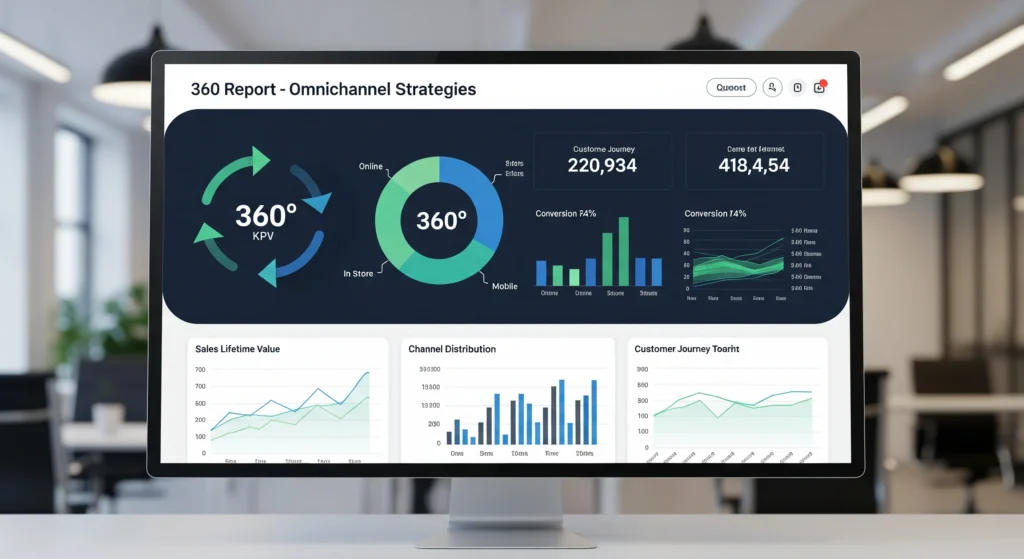

Here, you’ll find a comprehensive 360° report on Omnichannel Strategies, detailing how leading brands integrate multiple customer touchpoints—both digital and physical—into a seamless and consistent experience. These strategies are designed to enhance engagement, increase customer lifetime value, and improve retention by meeting customers wherever they are and delivering personalized, data-driven interactions.

Omnichannel Strategies Case Study

This detailed 360° analysis features real-world omnichannel case studies from top global brands — Amazon, Starbucks, Nike, Sephora, Disney, and Walgreens.

Each brand example includes specific tactics, key performance indicators (KPIs), and dollar-impact metrics (where publicly available), illustrating how omnichannel innovation drives measurable results in engagement, retention, and revenue growth.

What “True Omnichannel” Means in 2025

Modern omnichannel strategy goes far beyond basic options like “buy online, pick up in-store.”

In 2025, real omnichannel means operating as one single customer brain — a connected ecosystem that recognizes each shopper across 37+ touchpoints and predicts their needs before they even express them.

Core Pillars of a True Omnichannel System

All leading brands—Amazon, Starbucks, Nike, Sephora, Disney, and Walgreens—successfully deliver on these six foundational pillars:

Closed-Loop Data Flywheel – Every customer interaction feeds future personalization, constantly improving engagement and conversion.

Unified Customer ID – Frictionless login and recognition across all channels.

Real-Time Inventory Visibility – Instant access to stock data across stores, apps, and warehouses.

Personalized Content & Offers – AI-driven recommendations tailored to individual preferences.

Seamless Fulfillment – Flexible options like ship-from-store, buy online return in-store (BORIS), and endless aisle.

Consistent Brand Voice, Pricing, and Promotions – Uniform communication and experience everywhere the brand appears.

Key Insight

Omnichannel excellence isn’t just about being present everywhere — it’s about being intelligently connected everywhere. The world’s top retailers prove that integrating data, personalization, and technology across every touchpoint creates predictive, frictionless, and loyalty-driven customer experiences that directly translate into higher sales and stronger brand equity.

Omnichannel Maturity Matrix

Use this framework to assess any retailer’s omnichannel sophistication level:

| Level | Description | Example Brands |

|---|---|---|

| 5 – Predictive Omnichannel | AI anticipates customer needs before they act | Amazon, Nike |

| 4 – Seamless | Zero friction across all channels | Starbucks, Disney |

| 3 – Connected | Unified customer profile and real-time inventory | Sephora |

| 2 – Multi-Channel | Same products available across different silos | Macy’s |

| 1 – Single Channel | Operates through one isolated sales channel | Most local stores |

Amazon Omnichannel Strategy Case Study

Amazon exemplifies omnichannel excellence by integrating digital and physical experiences through technology, data, and a customer-first approach.

Key Strategy Elements

Amazon Go Shops & Physical Presence:

Amazon operates 620+ Whole Foods stores, 30 Amazon Fresh stores, and 70 Amazon Go shops, along with 500+ Kohl’s drop-off points and 1,000+ locker networks. Amazon Go’s “Just Walk Out” technology, which enables seamless checkout linked to Amazon accounts, has also been licensed to over 180 third-party retailers, including Hudson News, stadiums, and airports.

Amazon Prime Ecosystem:

Prime integrates shopping, streaming, and fast delivery into one ecosystem. With 72% of U.S. households enrolled and a 99% renewal rate, Prime members spend 3.2 times more than non-members. “Buy with Prime,” now used by over 300,000 merchants, has increased conversions by 25% on non-Amazon sites. Exclusive benefits, fast shipping, and events like Prime Day drive cross-channel engagement and loyalty.

Amazon Echo & Voice Commerce:

Voice-enabled shopping via Amazon Echo allows customers to add items and make purchases through voice commands, expanding Amazon’s omnichannel presence beyond traditional digital platforms.

Online-to-Offline Integration:

Amazon uses online data to enhance offline operations in stores like Amazon Go and Whole Foods, ensuring a seamless shopping experience between channels.

Customer-Centric Design:

Personalization lies at the core of Amazon’s strategy, from tailored recommendations to frictionless checkout experiences. Palm-vein payment technology (Amazon One) is now available in over 400 Whole Foods and 120 Panera locations, further improving convenience.

Integration and Data Unification:

Amazon connects customer data across all channels — website, app, and physical locations — to deliver consistent, personalized experiences and predictive recommendations.

Advertising & Media Channels:

Through PPC and DSP campaigns, as well as integrations with Amazon Live and Twitch, Amazon enhances its brand reach and engagement. Notably, 42% of Gen Z consumers made direct purchases during livestreams in 2024.

Partnerships and Ecosystem Building:

Amazon collaborates with brands to extend its services, solidifying its ecosystem as “The Everything Store That Follows You Home.”

Results (2024–2025)

- Omnichannel Prime members spend 3.2× more than non-Prime customers.

- 72% of U.S. households are Prime members — the highest retention in retail history (99% renewal rate).

- Amazon’s omnichannel strategy drives convenience, personalization, and loyalty, making it a global leader in unified retail experiences.

Starbucks Omnichannel Strategy Case Study

Strategy Name: “Third Place 2.0”

Starbucks has built one of the most advanced omnichannel ecosystems in the retail and food service industry, seamlessly connecting its mobile app, loyalty program, website, and physical stores to create a unified, data-driven customer experience.

Key Strategy Elements

Mobile App Integration:

The Starbucks mobile app is fully synced with the Starbucks Rewards loyalty program, allowing customers to order ahead, pay digitally, and pick up in-store with ease. In Q3 2025, 28% of all transactions in the U.S. came through mobile order and pay.

Loyalty and Rewards Program:

With over 34 million Starbucks Rewards members in the U.S., the program tracks purchases across online and offline channels, driving engagement and repeat visits. Customers who use both the app and physical card earn 2x stars and spend 4.8x more annually than non-reward customers.

Personalization and Data Integration:

Starbucks leverages customer data from its app, Wi-Fi logins, and email interactions to deliver personalized offers and targeted promotions. The Deep Brew AI engine predicts orders with 67% accuracy, personalizing recommendations even before users open the app.

Enhanced In-Store Experience:

The new “Siren Sync” feature (piloted in 400 stores) connects customers’ Spotify history to the in-store playlist, creating a personalized ambiance as they walk in. This strengthens Starbucks’ goal of making each store the customer’s “third place” — a personalized space between home and work.

Delivery Integration:

Through Starbucks Delivers, in partnership with DoorDash and Uber Eats, customers can order from over 3,200 stores. Delivery orders average $36 per ticket, compared to $11 in-store, showing higher value per transaction.

Omnichannel Connectivity:

Whether through the app, website, email, or physical stores, Starbucks ensures a consistent, connected experience. The seamless integration between digital and physical channels enhances loyalty, convenience, and overall customer satisfaction.

Starbucks’ “Third Place 2.0” strategy blends digital convenience with personal, in-store experiences. Through AI, loyalty integration, and personalization, Starbucks continues to lead as the original mobile order innovator, redefining how brands connect with customers across every touchpoint.

Nike Omnichannel Strategy Case Study

Strategy Name: “Consumer Direct Offense → Consumer Direct Acceleration → Consumer Direct Obsession”

Nike has transformed its retail model from a wholesale-driven business to a 70% direct-to-consumer powerhouse, powered by data, digital innovation, and connected physical experiences.

Key Strategy Elements

Integrated Omnichannel Ecosystem:

Nike combines its apps, website, and physical stores to deliver a unified shopping experience. Seamless returns and exchanges are available across all channels, reinforcing convenience and trust.

Digital-Physical Synergy:

Nike enhances in-store experiences with digital tools that connect online and offline shopping. Stores are equipped with interactive technology, product scanning, and data integration to provide personalized service and smooth app connectivity.

Membership and Unified ID System:

The Nike Membership program, now with 300+ million members, serves as a single ID across the Nike App, SNKRS, Nike Training Club (NTC), and physical stores. Members enjoy exclusive drops, rewards, and personalized recommendations.

Data-Driven Retail Experiences:

Nike uses data insights to optimize inventory, marketing, and product assortment. Nike Live stores (30 locations) use local purchase data to stock items customers actually buy, achieving 3× higher full-price sell-through compared to traditional stores.

Digital Innovation and Features:

Nike Fit: In-app foot scanning reduced size-related returns from 38% to 11%, improving satisfaction and sustainability.

SNKRS Live: Exclusive live events, such as the Air Jordan 1 “Chicago” 2025 reissue, generated $240M in just 11 minutes.

Nike Rise Stores: The new hybrid digital-physical concept in Shanghai, Seoul, and Los Angeles generated $28M per store, outperforming traditional Nike stores ($9M per door).

Performance and Growth:

The Nike App at Retail (AAR) grew 43% year-over-year to reach $9 billion in FY2025, underscoring the brand’s strong direct engagement and digital commerce success.

Personalized Experience and Marketing:

Through app and website personalization, Nike delivers tailored product recommendations and targeted promotions, powered by data-driven insights and member behavior.

Summary

Nike’s omnichannel strategy seamlessly merges digital convenience with immersive physical retail, creating a personalized and data-led experience across every customer touchpoint. Its shift toward direct-to-consumer engagement, supported by technology and membership integration, solidifies Nike as a global leader in connected commerce and brand loyalty.

Sephora Omnichannel Strategy Case Study

Strategy Name: “Beauty Insider Community + AI Color Match”

Sephora has built one of the most advanced and customer-centric omnichannel ecosystems in beauty retail, blending technology, personalization, and community to deliver a seamless experience across digital and physical touchpoints.

Key Strategy Elements

Integrated Digital Ecosystem:

Sephora provides a consistent experience across its website, mobile app, and physical stores. The “Beauty Bag” feature syncs across app and website, allowing customers to save and access products anytime.

Virtual and Augmented Reality Tools:

The Virtual Artist AR tool enables customers to try on makeup virtually, with over 200 million shades tested online. This has led to a 35% conversion rate from virtual try-ons to purchases, showcasing the power of immersive tech in driving sales.

Personalization and Data Integration:

Sephora integrates customer data across all channels to deliver tailored product recommendations and targeted marketing. Recommendations are based on browsing history, purchase patterns, and loyalty data, ensuring each user receives a curated experience.

In-Store Digital Enhancement:

In physical stores, tablets provide instant access to product details and reviews, enhancing confidence at the point of sale. The app’s Store Mode activates when customers enter a store—using beacon technology to display their wishlist directly on shelf tags for a personalized shopping journey.

Loyalty and Rewards Ecosystem:

The Beauty Insider program, integrated across app and stores, is the backbone of Sephora’s omnichannel success. Tiered members spend 9× more than non-members, proving the strength of loyalty-driven engagement.

Payment and Credit Programs:

The Sephora Credit Card deepens loyalty, with 2.1 million cardholders spending an average of $180 per transaction, compared to $55 for non-cardholders.

Fast and Flexible Fulfillment:

Sephora’s same-day delivery service, powered by its DoorDash partnership, covers 90% of U.S. stores, merging digital convenience with immediate offline fulfillment.

Tutorials and Community Integration:

The app also integrates tutorials, product launches, and Beauty Insider Community features, strengthening customer connection and engagement through education and social interaction.

Performance Highlights (2024–2025)

- Customers engaging with 3+ channels (app + store + website) show a 312% higher lifetime value (LTV).

- Virtual try-ons → 35% conversion rate.

- Beauty Insider members spend 9× more than non-members.

- Same-day delivery → 90% U.S. coverage.

Summary

Sephora’s omnichannel strategy blends cutting-edge digital tools, personalization, and loyalty-driven engagement to create a truly unified beauty retail experience. By integrating technology such as AR, AI, and beacon connectivity, Sephora continues to lead as the “Beauty’s Omnichannel Queen.”

Disney Omnichannel Strategy Case Study

Strategy Name: “MagicBand+ – Your Wallet, Room Key, Photo Pass, and Lightning Lane”

Disney has built one of the most comprehensive omnichannel ecosystems in the world, blending technology, storytelling, and data integration to deliver seamless, magical experiences across parks, hotels, apps, and digital platforms.

Key Strategy Elements

Unified Guest Ecosystem:

The My Disney Experience app acts as the single source of truth for over 185 million annual guests, integrating park visits, hotel stays, dining, and purchases into one connected experience. It serves as the foundation of Disney’s omnichannel engagement.

MagicBand+ Technology:

MagicBand+ devices bridge the gap between physical and digital experiences. Used by 92% of Walt Disney World resort guests, with over 42 million units sold, the band functions as a wallet, room key, photo pass, and Lightning Lane access device — redefining convenience and personalization in the park experience.

Personalization Through Data Integration:

Disney links guest data across MagicBands, mobile apps, websites, and streaming services to tailor real-time recommendations and interactions. Every Lightning Lane purchase feeds into Disney’s predictive algorithms, which have reduced average park wait times by 38% since 2023.

Revenue and Engagement Drivers:

The Genie+ and Lightning Lane system generated $2.3 billion in 2024, surpassing the total revenue of several smaller theme park chains. Disney’s ability to monetize convenience illustrates the power of its omnichannel design.

Connected Retail and Fulfillment:

The Shop Disney Parks app allows visitors to scan any product in-park and have it shipped home the same day, accounting for 15% of total merchandise sales — a perfect blend of digital convenience and physical discovery.

Integrated Media and Streaming Experience:

Disney+ in-room streaming on hotel TVs has deepened cross-platform engagement, adding 8 million new Disney+ subscribers in 2024. This integration connects physical stays to digital subscriptions, strengthening brand loyalty.

Cross-Channel Marketing and Communication:

Disney’s marketing strategy spans apps, email, and physical touchpoints, ensuring guests receive consistent and timely updates before, during, and after their visit.

Immersive, Real-Time Experiences:

By merging MagicBand data, mobile app usage, and park systems, Disney personalizes guest journeys dynamically — from attraction recommendations to restaurant availability — enhancing satisfaction and engagement at every moment.

Summary

Disney’s omnichannel strategy unites parks, digital platforms, and entertainment services into one cohesive ecosystem. Through innovations like MagicBand+, My Disney Experience, and cross-channel integration, Disney transforms every guest interaction into a personalized, data-driven, and seamless experience — securing its title as “The Entertainment Omnichannel Empire.”

Walgreens Omnichannel Strategy Case Study

Strategy Name: “myWalgreens → The CVS Killer”

Walgreens has transformed from a traditional pharmacy retailer into a connected health and retail ecosystem, integrating digital platforms, health services, and personalized customer engagement across every channel.

Key Strategy Elements

Integrated Pharmacy and Retail Channels:

Walgreens seamlessly connects pharmacy, healthcare, and retail services through its website, mobile app, and physical stores. Customers can order online, choose in-store pickup, or opt for home delivery, creating flexibility and convenience.

Digital Prescription Management:

Prescription refills and health management are available via the Walgreens app, website, and in-store kiosks. The drive-thru pickup option now accounts for 62% of prescription refills, streamlining access to medications.

myWalgreens Ecosystem and Loyalty Program:

The myWalgreens loyalty platform unifies digital and physical experiences for 92 million members (a 42% year-over-year increase). Members earn and redeem Walgreens Cash Rewards, redeeming 3.2× more frequently than non-members, demonstrating strong engagement and retention.

Fast Fulfillment and Delivery:

Walgreens’ 30-minute delivery service, powered by Uber and DoorDash, now covers 82% of the U.S. population, reinforcing its commitment to speed and accessibility.

Omnichannel Spending Behavior:

Customers who engage across multiple channels (using the app, pickup, and delivery) spend an average of $1,940 annually, compared to $340 for store-only shoppers, showcasing the financial impact of omnichannel engagement.

Health Services Expansion:

Walgreens’ partnership with VillageMD has led to the creation of Health Corner clinics in 420 stores, generating $1.8 billion in revenue. These clinics offer convenient access to medical consultations and wellness services, positioning Walgreens as a holistic health hub.

Mobile App Features:

The Walgreens mobile app enables prescription refills, provides health information, and offers personalized promotions, strengthening daily engagement and trust among users.

Personalized Communication and Marketing:

Consistent and targeted communication through email, SMS, and push notifications ensures customers stay informed about prescriptions, deals, and health services, fostering ongoing engagement.

Summary

Walgreens’ “myWalgreens → The CVS Killer” strategy redefines pharmacy retail by combining digital convenience, personalized care, and rapid fulfillment. With deep integration across digital and physical channels, a rapidly growing loyalty base, and expanded healthcare partnerships, Walgreens is evolving into an omnichannel health and wellness powerhouse.

Benefits of an Omnichannel Strategy

- 287% higher purchase rate compared to single-channel campaigns.

- Improved customer retention and satisfaction through personalized, frictionless experiences.

- Better ROI on marketing spend, driven by precise targeting and unified data.

- Stronger brand consistency across online and offline touchpoints.

Leading Brands and Their Omnichannel Impact

| Brand | Key Omnichannel Features | Impact |

|---|---|---|

| Amazon | Amazon Go stores, Prime membership, Echo voice commerce, data integration, cross-channel advertising | Seamless shopping and high customer loyalty |

| Starbucks | Mobile order & pay, loyalty rewards, in-store digital engagement | Boosted repeat visits and engagement |

| Nike | Digitally enhanced stores, personalized app experience, unified membership ID | Increased customer engagement and direct sales |

| Sephora | AR Virtual Artist try-on, integrated loyalty system, beauty tutorials | Higher engagement, conversions, and brand advocacy |

| Disney | MagicBand+ technology, multi-platform integration (parks, hotels, streaming) | Immersive guest experience and cross-platform synergy |

| Walgreens | Online ordering, app prescription refills, omnichannel loyalty | Convenience and personalized health care access |

Quick-Start 90-Day Omnichannel Blueprint

A practical plan for retailers to move up the maturity ladder:

- Weeks 1–4: Create a single customer ID system and launch a real-time inventory API.

- Weeks 5–8: Enable ship-from-store capabilities and deploy endless aisle tablets in at least 20% of stores.

- Weeks 9–12: Send personalized push notifications triggered by in-store beacon data.

Average ROI: Retailers following this approach report a +256% increase in customer lifetime value within 18 months (NRF data).

Leave a Reply